EPFO Passbook Amount – The Employees’ Provident Fund Organisation (EPFO) is a cornerstone of financial security for millions of employees in India. It ensures that salaried workers have a safety net for retirement through contributions to the Provident Fund (PF). Checking and verifying your EPFO balance is crucial to stay informed about your savings, track contributions, and plan your financial future. This guide provides an in-depth look at how to verify and check your EPFO amount using various methods, including online portals, mobile apps, SMS, missed calls, and more. We’ll also cover troubleshooting tips, common issues, and frequently asked questions to make the process seamless.

What is EPFO and Why Check Your PF Balance?

The EPFO is a statutory body under the Ministry of Labour and Employment, Government of India, responsible for managing the Provident Fund, Pension Scheme, and Insurance Scheme for employees in the organized sector. The Provident Fund is a mandatory savings scheme where both employees and employers contribute a portion of the employee’s salary (typically 12% each) to a fund that earns interest and can be withdrawn upon retirement or under specific conditions.

Regularly checking your EPFO balance is essential for several reasons:

- Transparency: Ensures that your employer is making timely and accurate contributions.

- Financial Planning: Helps you gauge your savings and plan for retirement or emergencies.

- Error Detection: Identifies discrepancies in contributions or interest calculations.

- Claim Preparation: Provides clarity on available funds when applying for withdrawals or transfers.

With advancements in technology, EPFO has made it easier than ever to check your PF balance through multiple channels. Let’s explore these methods in detail.

Methods to Check and Verify EPFO Amount

EPFO offers several user-friendly methods to check your PF balance, catering to different levels of tech-savviness and accessibility. Below are the primary methods, complete with step-by-step instructions.

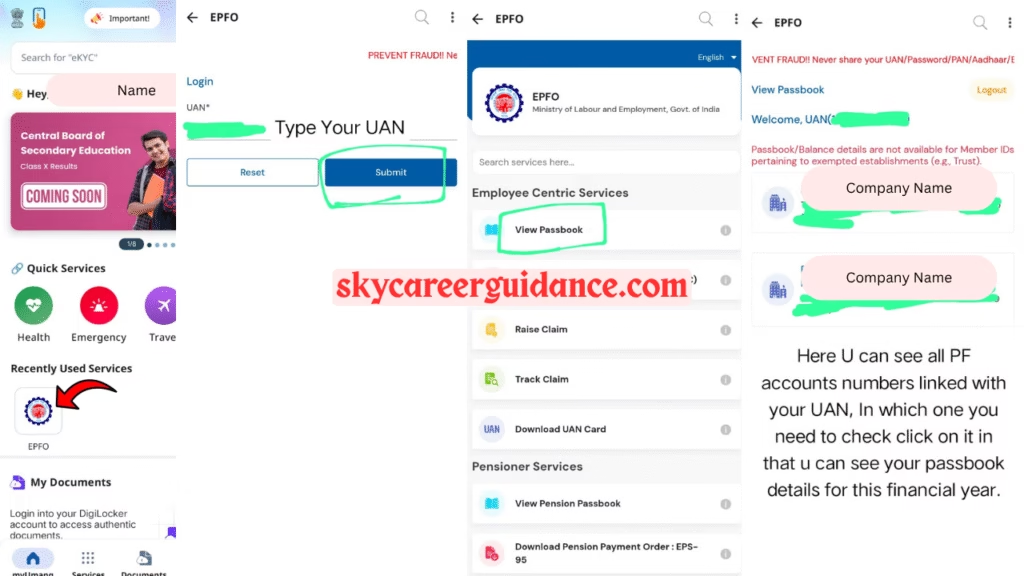

1. Checking EPFO Balance via UMANG App

The Unified Mobile Application for New-age Governance (UMANG) is a government-initiated app that integrates various services, including EPFO, into a single platform. It’s ideal for smartphone users who prefer a mobile app interface.

Steps to Check PF Balance on UMANG App:

- Download the App: Install the UMANG app from the Google Play Store or Apple App Store.

- Register/Login: Sign up using your mobile number and verify it with an OTP. If already registered, log in.

- Select EPFO Service: On the app’s homepage, search for “EPFO” or navigate to the EPFO section under “Services.”

- Choose ‘Employee Centric Services’: Select the option to view your passbook or check your balance.

- Enter UAN and OTP: Provide your Universal Account Number (UAN) and request an OTP, which will be sent to your registered mobile number.

- View Passbook: After OTP verification, you can view your PF passbook, which details contributions, interest, and total balance.

Advantages:

- User-friendly interface.

- Access to multiple government services in one app.

- Secure with OTP-based authentication.

Requirements:

- Smartphone with internet access.

- Registered mobile number linked to UAN.

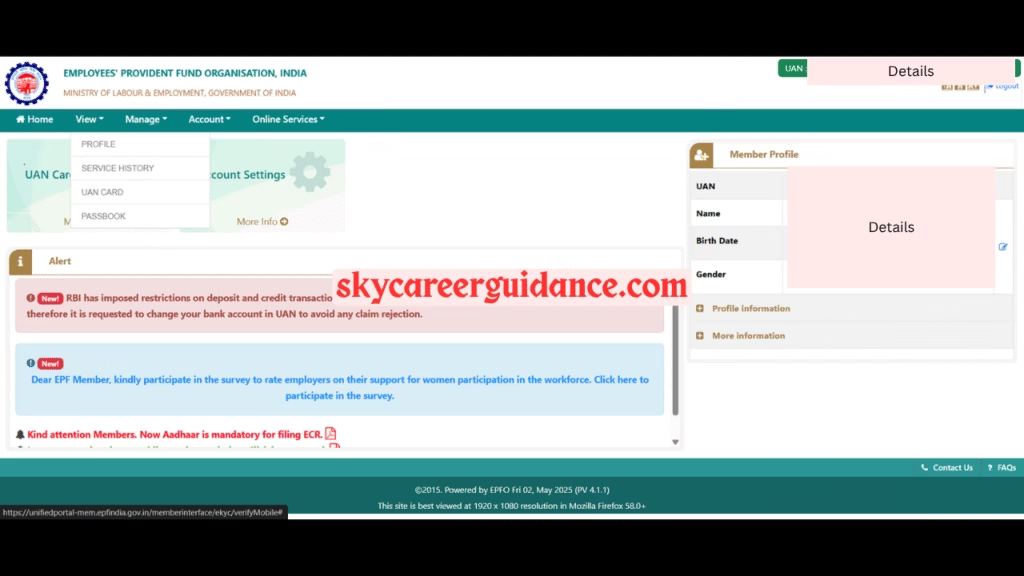

2. Checking EPFO Balance via EPFO Member Portal

The EPFO Member Portal is the official online platform for PF-related services. It’s ideal for users who prefer accessing their account via a web browser.

Steps to Check PF Balance on EPFO Portal:

- Visit the Portal: Go to the EPFO Member Portal at unifiedportal-mem.epfindia.gov.in.

- Log In: Click on “For Members” and select “Member Passbook.” Enter your UAN, password, and CAPTCHA code.

- Access Passbook: After logging in, select your PF account (if you have multiple accounts linked to your UAN) and click “View Passbook.”

- Download/Review: The passbook will display your PF balance, contributions, and interest. You can download it as a PDF for records.

Advantages:

- Detailed transaction history.

- Option to download passbook for offline reference.

- No need to install additional apps.

Requirements:

- Active UAN and password.

- Internet-enabled device (PC, laptop, or smartphone).

- Linked Aadhaar and bank details for seamless access.

Tip: If you’ve forgotten your password, use the “Forgot Password” option to reset it via OTP sent to your registered mobile number.

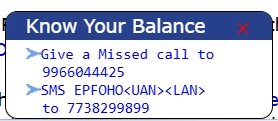

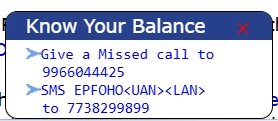

3. Checking EPFO Balance via Missed Call Service

For users without internet access or smartphones, EPFO provides a missed call service to check PF balance instantly. This is one of the simplest methods.

Steps to Check PF Balance via Missed Call:

- Ensure KYC Compliance: Your mobile number must be linked to your UAN, and KYC (Aadhaar, PAN, and bank details) must be completed.

- Give a Missed Call: Dial 9966044425 from your registered mobile number and hang up after a ring.

- Receive SMS: Within a few seconds, you’ll receive an SMS with your PF balance and last contribution details.

Advantages:

- No internet or smartphone required.

- Quick and hassle-free.

- Free of charge.

Limitations:

- Provides only basic balance information.

- Works only with the registered mobile number.

Note: If you don’t receive an SMS, verify your KYC status on the EPFO portal or contact your employer.

4. Checking EPFO Balance via SMS

The SMS service is another offline method to check your PF balance, suitable for users with basic mobile phones.

Steps to Check PF Balance via SMS:

- Verify KYC: Ensure your UAN is linked to your mobile number and KYC is updated.

- Send SMS: From your registered mobile number, send the following message to 7738299899:

EPFOHO UAN LANReplace “UAN” with your Universal Account Number and “LAN” with your preferred language code (e.g., ENG for English, HIN for Hindi).

Example:EPFOHO 123456789012 ENG - Receive Response: You’ll receive an SMS with your PF balance, last contribution, and other details.

Advantages:

- Works on any mobile phone.

- Supports multiple languages (English, Hindi, Tamil, Telugu, etc.).

- No internet required.

Limitations:

- Limited to registered mobile numbers.

- May not provide detailed transaction history.

5. Checking EPFO Balance via EPFO Mobile App

EPFO has a dedicated mobile app, “m-Seva,” for PF-related services. While less popular than UMANG, it’s a direct channel for EPFO services.

Steps to Check PF Balance on m-Seva App:

- Download the App: Search for “EPFO Member” or “m-Seva” on the Google Play Store or Apple App Store and install it.

- Log In: Enter your UAN, password, and CAPTCHA code to log in.

- View Passbook: Navigate to the passbook section to check your PF balance and transaction history.

- Explore Other Services: The app also allows you to track claims, update KYC, and more.

Advantages:

- Direct access to EPFO services.

- Lightweight app with a simple interface.

- Secure login process.

Requirements:

- Smartphone with internet access.

- Active UAN and password.

6. Checking EPFO Balance via Passbook Portal

The EPFO Passbook Portal (passbook.epfindia.gov.in) is a dedicated platform for viewing and downloading your PF passbook. It’s similar to the Member Portal but focuses solely on passbook access.

Steps to Check PF Balance on Passbook Portal:

- Visit the Portal: Go to https://passbook.epfindia.gov.in/MemberPassBook/login.

- Log In: Enter your UAN, password, and CAPTCHA code.

- Select Account: Choose the relevant PF account if multiple accounts are linked.

- View/Download Passbook: Check your balance and download the passbook for records.

Advantages:

- Focused on passbook access, reducing clutter.

- Easy to navigate.

- Downloadable PDF passbook.

Requirements:

- Active UAN and password.

- Internet-enabled device.

Prerequisites for Checking EPFO Balance

To use any of the above methods, you need to meet the following prerequisites:

- Activated UAN: Your Universal Account Number must be activated. You can activate it on the EPFO Member Portal using your Aadhaar, PAN, or bank details.

- Registered Mobile Number: Your mobile number must be linked to your UAN for OTP-based authentication or SMS/missed call services.

- KYC Compliance: Aadhaar, PAN, and bank account details must be updated and verified in the EPFO database.

- Password (for online methods): You need a password for the EPFO Member Portal or Passbook Portal. If not set, create one during UAN activation.

How to Update KYC:

- Log in to the EPFO Member Portal.

- Go to “Manage” > “KYC” and enter details like Aadhaar, PAN, and bank account.

- Submit for employer approval. Once approved, your KYC will be updated.

Troubleshooting Common Issues

While checking your EPFO balance is generally straightforward, you may encounter issues. Here’s how to address common problems:

- “Invalid UAN” Error:

- Cause: Incorrect UAN or unactivated UAN.

- Solution: Verify your UAN with your employer or payslip. Activate it on the EPFO portal if not done.

- No SMS Response (Missed Call/SMS Service):

- Cause: Unregistered mobile number or incomplete KYC.

- Solution: Update your mobile number and KYC on the EPFO portal. Ensure you’re using the registered number.

- Login Failure on Portal/App:

- Cause: Wrong password or CAPTCHA issues.

- Solution: Reset your password using the “Forgot Password” option. Clear browser cache if CAPTCHA fails.

- Passbook Not Available:

- Cause: Employer hasn’t updated contributions, or account details are incomplete.

- Solution: Contact your employer to update contributions. Verify KYC status.

- Discrepancy in Balance:

- Cause: Missing contributions or calculation errors.

- Solution: Raise a grievance on the EPFO portal (epfigms.gov.in) or visit the nearest EPFO office.

Benefits of Regularly Checking EPFO Balance

Monitoring your EPFO balance offers several advantages:

- Financial Awareness: Stay informed about your retirement savings.

- Employer Accountability: Ensure your employer is contributing regularly.

- Error Correction: Spot and rectify discrepancies early.

- Loan/Withdrawal Planning: Know your available balance for partial withdrawals (e.g., for marriage, housing, or medical emergencies).

- Tax Planning: PF contributions are tax-exempt under Section 80C, so tracking helps with tax calculations.

EPFO Balance Verification for Claim Purposes

If you’re planning to withdraw or transfer your PF balance, verifying the amount is critical. Here’s how to prepare:

- Check Latest Balance: Use any of the methods above to confirm your available balance.

- Verify KYC: Ensure Aadhaar, PAN, and bank details are updated to avoid claim rejections.

- Track Contributions: Review your passbook to confirm all contributions are recorded.

- Submit Claim: Use the EPFO Member Portal to apply for withdrawals or transfers. Track claim status on the portal or m-Seva app.

Frequently Asked Questions (FAQs)

- What is UAN, and how do I get it?

- UAN is a 12-digit Universal Account Number assigned to every PF member. Your employer provides it during your PF registration. You can also find it on your payslip or by contacting your HR department.

- Can I check my PF balance without UAN?

- No, UAN is mandatory for most methods. However, you can retrieve your UAN from your employer or the EPFO portal using your PF account number.

- Why is my passbook showing “Not Available”?

- This could be due to pending employer contributions, incomplete KYC, or technical issues. Contact your employer or EPFO for resolution.

- Is the missed call service free?

- Yes, the missed call service (9966044425) is free, but it works only with your registered mobile number.

- How often should I check my PF balance?

- Check at least quarterly to ensure contributions are updated and to spot discrepancies early.

- Can I check PF balance for multiple accounts?

- Yes, if multiple PF accounts are linked to your UAN, you can view all passbooks on the EPFO portal or apps.

Tips for Secure EPFO Balance Checking

To protect your PF account from fraud or unauthorized access:

- Use Strong Passwords: Create a unique, strong password for the EPFO portal.

- Avoid Public Wi-Fi: Don’t access the portal or apps on unsecured networks.

- Update KYC Regularly: Keep your mobile number and email updated to receive OTPs.

- Beware of Scams: EPFO never asks for sensitive details via email or SMS. Report suspicious messages to EPFO.

Conclusion

Checking and verifying your EPFO balance is a vital step toward financial security and transparency. With multiple methods like the UMANG app, EPFO portal, missed call, SMS, and m-Seva app, EPFO has made the process accessible to everyone, regardless of technological proficiency. By regularly monitoring your PF balance, you can ensure your employer’s contributions are accurate, plan your finances, and prepare for withdrawals or transfers with confidence.

Start by activating your UAN and completing KYC if you haven’t already. Choose the method that suits your needs—whether it’s the convenience of a mobile app or the simplicity of a missed call—and stay informed about your hard-earned savings. If you encounter issues, use the troubleshooting tips or reach out to EPFO’s grievance portal for assistance.

By following this guide, you’re well-equipped to navigate the EPFO system and take control of your Provident Fund savings. Stay proactive, stay informed, and secure your financial future with EPFO.

For More Articles Visit Website

For more job updates, technology news other articles visit website click here

Tags: EPFO Passbook, Sky Career Guidance, UMANG, Balance Check, Passbook, epfo Passbook check.